We can advise you on life assurance, pensions, other

retail investment products, consumer credit and other

investments. We can also advise on pure protection and private medical insurance contracts from a range of insurers.

At the heart of what we do is a passionate focus on the individual – your situation, your needs, your aims and objectives. It’s this personalised interaction with our clients that inspires truly bespoke, long-term financial solutions.

The services that we can provide are tailored to your specific needs and aspirations for the future.

Let’s make a plan

GENERAL FINANCIAL TIDY UP AND OVERVIEW

We can provide a detailed, expert overview of your current financial situation. This usually includes a technical analysis of your existing policies, investments, savings, mortgages and business finance*.

CORPORATE FINANCE

We consider the last 3 years accounting evidence in order to tailor commercial financing for your business. We provide guidance in areas such as:

Overdraft facilities*

Capital expenditure loans*

Business loans*

INVESTMENT PORTFOLIO MANAGEMENT

We offer a range of different investment propositions depending on your objectives and which service best suits your needs. The savings and investments we structure mirror your personal attitude towards risk, and your tolerance for volatility.

PENSION AND RETIREMENT PROVISION

We can help structure your finances and consolidate your pension products should you wish to have the option of stopping work in the future.

PERSONAL AND CORPORATE PROTECTION

We can advise on suitable critical illness and life cover options that would meet the financial demands of your personal situation. We also consider the possible impact on your business should you lose a key member of staff to serious illness.

INHERITANCE TAX PLANNING

We can help ensure your Will reflects your wishes, and is written in a way that will take into consideration inheritance tax mitigation. We oversee powers of attorney and trust implementation, and would work with your lawyers to update and manage this process on an annual basis.

MORTGAGES

Our dedicated mortgage team will guide you through the mortgage process and look to overcome any possible pitfalls. We have independent capability to source the most appropriate mortgage deal and present your application to the most suitable lender.

A goal without a plan is just a wish

How we charge

We believe that strong, long-term client relationships can only be built on a foundation of trust. That’s why, as a first step, we’ve always made a point of being completely transparent about the way we work: from how we structure our fees to how we help you make educated decisions about your financial future.

As independent financial advisers, our consultants receive no bonuses or commissions – just a well-earned salary. At Timothy James & Partners, what you’re paying for is experience, expertise, and our uncompromising dedication to your financial well-being.

We discuss our fee structures at the start of the advice process, and keep you fully informed about the prices of any products or solutions we recommend. So whatever your financial needs, you can be confident that you know exactly what you’re paying for.

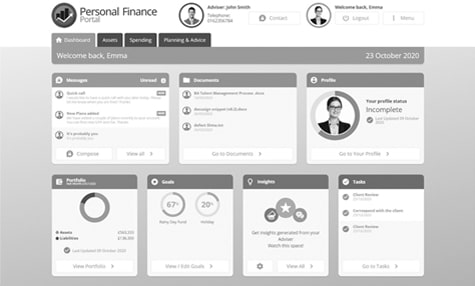

Client portal

We use a Personal Finance Portal (PFP) is a revolutionary app that gives you access to view all your finances in one place 24/7 on any mobile or web device. PFP enables you to view your fund information and financial portfolio at the click of a button. So whether you’re looking for an up-to-date valuation of your portfolio, want to assess how you’re progressing against your goals or simply wish to get in touch, PFP has it covered.

Talk to us

We’re only a phone call away. Or send us a note and we’ll call you back.

Wealth is not his that has it, but his that enjoys it.