You can expect to follow a tried and tested process; one that’s designed to give us all the information we need to deliver truly tailored solutions, and to provide you with tools to help you achieve your financial aims.

The process may take a little time, but

it’s worth every minute. You’ve come to us for tailored advice that’s expertly honed to support your lifestyle, and this is how we deliver it.

If you do not tell the truth about yourself you cannot tell it about other people.

The financial planning

process for initial advice

We meet to explore your current requirements and future objectives, and agree how best we can work together. This is when we run through our fact find and get to know your world on a deeper basis – family situation/dependants; properties; professional life including directorships/companies/share holdings etc. and financial objectives.

They can go up or down depending on property

market cycles, spending patterns and the world in

general. If your house has gone down in value but your

investments and savings have gone up – it’s about

understanding the trend year in year out.

We study your monthly/annual outgoings in detail; this may include your mortgage or rent payments, household utilities, medical care and the weekly shop.

From these findings we can consider your future income requirements: what you need to generate now against what you will need in years to come – for example, income needs now versus income needs later in life.

Risk profiling is the financial services equivalent of the first blood pressure machine. While an accurate blood pressure reading does not, by itself, determine a diagnosis or treatment, it does provide critically important information!

We perform an analysis and assessment to pinpoint where you are on the risk tolerance scale, and

to ensure that any recommendations we make are within your comfort zone.

We look at your assets and liabilities – what you own versus what you owe – and gather the data into a statement. We use this to help calculate your wealth and inheritance tax liability, and it’s a very useful document to send to your solicitor to help them draft your will.

The value of your individual assets may change every year. They can go up or down depending on property market cycles, spending patterns and the world in general. If your house has gone down in value but your investments and savings have gone up – it’s about understanding the trend year in year out.

The Financial Summary is one document that provides an overview of your current protection, investments and pensions. We use it to help us analyse and research your existing plans, and to give you an independent view of the advantages and disadvantages of the financial arrangements you have accumulated over the years.

We may make recommendations to switch, consolidate or focus these arrangements to ensure they remain relevant both to today’s economic environment and your personal

financial situation and objectives.

At this point we introduce your support team and dedicated Finance Executive, who will be your personal point of contact going forward. This person and the support team work alongside your adviser and are fully aware of who you are and what we are doing for you.

Their financial knowledge is technically advanced and their role primarily focuses on researching the various options you have discussed with your adviser, so they can ‘hand-hold’ you through the process from start to finish. They are always available to answer any questions you may have.

We’ll go through our fee structure fully on a one-to-one basis, and you can also find a comprehensive breakdown of the charges enclosed. We want to ensure that you have a clear understanding of our fees and the services we provide and welcome a discussion with you about these at any time; what you’re paying for is our dedication to your financial well-being, and we want to be as open about that as soon as possible.

Once we have established the best solution for your needs we will provide a full breakdown of all charges; ours, the product providers and the fund managers. This is a percentage of your money and we’ll

explain what that is in pounds, shillings and pence! We want you to feel comfortable enough to have an open conversation with us about our initial and on-going fees

whenever you want.

Based on all our fact-finding to date, we put together a clear and concise overview of your current financial situation, and your future objectives across a given timescale.

This written overview provides you and us with a resume of our initial discussions, your financial background and objectives. It’s all about you, written in plain English.

We bring specialist insights and solutions to the table in order to create a finely tailored and holistic financial structure. We then advise on the best implementation and management of this structure in order to maximise the chances of achieving your objectives.

By this stage we should know the costs and the fee structure, and we will seek your agreement before proceeding any further. You always have the option of changing your mind at any point during the advice or administration process.

Having spent a considerable amount of time getting to know you and understanding your current financial situation and objectives, we can now make recommendations. Typically we will be researching your existing contracts, discussing potential new options and comparing solutions.

We use the structure of the plan to recommend ideas, products and investments to meet your specific

requirements. This is where we bring everything together, either in the form of a recommendation letter or a

Discussion Document. This provides the technical detail and charges and should be read in conjunction with the overview letters.

We put all the agreed plans in place and implement them for you – leaving you free to get on with the business

of living! Your Finance Executive and support team can help you with your paperwork, and will email and

phone you to keep you informed all the way through to completion.

You always have the option of changing your mind at any point during the administration process.

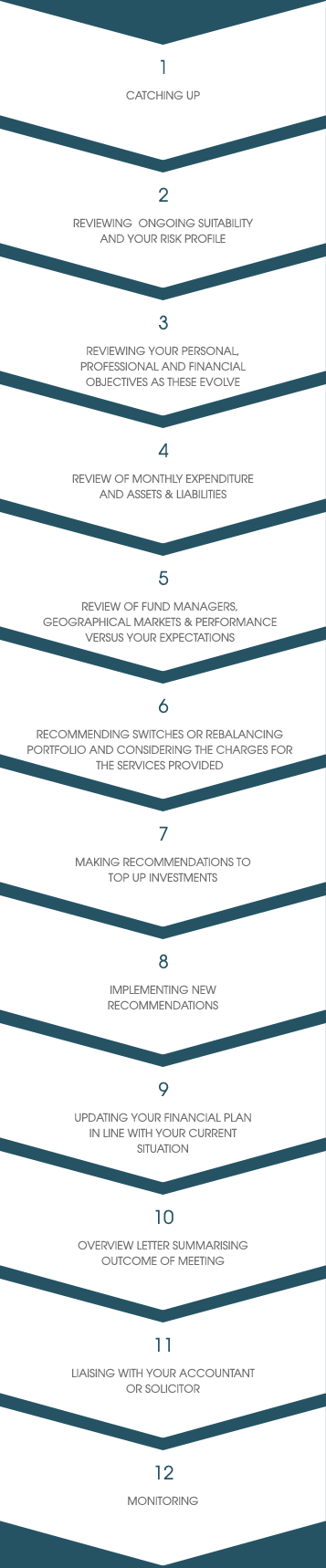

The financial planning

process for ongoing advice

Our services

From tidying up your finances to helping you plan retirement, we look after your investments and guide you through the process for your whole financial life.

Our servicesEverything is simpler than you think and at the same time more complex than you imagine.